How to track expenses using Excel starts with knowing where your money goes. In today’s world, how to track expenses using Excel is more than just a good habit—it’s something you must do to stay in control and grow your money. Whether you want to pay off loans, save for something big, or just watch your spending, learning to track expenses with Excel is a smart move.

Excel is the perfect tool for this job. It’s flexible and doesn’t have monthly fees like many money apps. While some apps might stop working or start charging more, Excel gives you a tool you can always use and change to fit your needs. Plus, since Excel is so common, you can open your tracker on almost any computer.

This step-by-step guide will help you go from being new to Excel to becoming great at tracking your money. You’ll learn how to track expenses using Excel with smart setups, easy ways to add your data, powerful tools to study your spending, and tips to keep your tracker going. By the end, you’ll know how to use Excel like a pro to manage your money as your needs grow.

Must Read: What Are Some Time-Saving Tips for Excel? 25 Expert Strategies to Boost Your Productivity

Why Track Expenses in Excel?

The Financial Awareness Game-Changer

Tracking your expenses in Excel helps you see where your money really goes, not just where you think it goes. Most people spend 20–30% more than they realize until they start tracking carefully. Excel makes it easy to see and understand your spending.

By tracking expenses often, you can spot spending habits that hurt your budget. Little things like daily coffee, random online shopping, and unused subscriptions can add up fast. Excel helps you find these money leaks right away.

Tracking also helps you reach your savings goals faster. Whether you’re saving for a trip, an emergency fund, or a big buy, Excel shows how much you can save just by cutting out extra spending.

Why Choose Excel Over Other Tools?

Excel gives you more control than most money apps. You can change the layout, add columns, and set up your categories to fit your needs.

Most computers already have Excel, so there’s no extra cost. And unlike many money apps, Excel doesn’t charge monthly fees.

Excel is great at turning data into useful information. With built-in tools like functions, charts, and pivot tables, you can easily see spending trends and make better choices with your money.

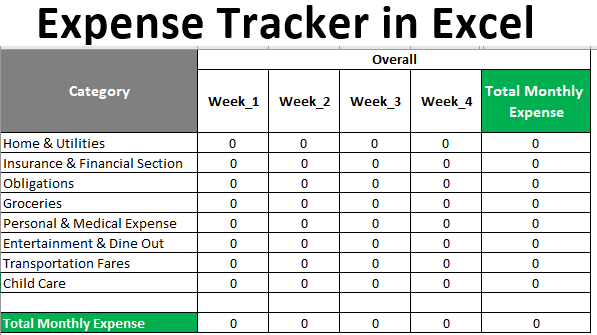

Setting Up Your Excel Expense Tracker

Choosing Your Tracker Structure

Single Sheet Method:

- Best for beginners

- All expenses in one place

- Simple to manage

- Good for basic tracking

Multi-Sheet Workbook:

- More organized

- One sheet for each month

- Extra pages for category summaries

- Dashboard view of your spending

If you’re just starting out, begin with one sheet. You can add more sheets later as you get used to tracking.

Essential Columns for Expense Tracking

Must-Have Columns:

- Date: Use one format (MM/DD/YYYY)

- Category: Like Food, Transportation, or Bills

- Description: What you spent money on

- Amount: How much you spent, in dollars

- Payment Method: Cash, Credit, or Debit

Optional Columns:

- Sub-Category: Like “Groceries” or “Dining Out” under Food

- Notes: Any extra details

- Budget Status: How much money is left in that category

Excel Formatting Best Practices

Make your tracker easy to read:

- Headers: Bold and clear

- Dates: Same MM/DD/YYYY format

- Currency: Use $ with two decimal places

- Freeze Panes: Keep headers at the top as you scroll

- Table Format: Use colored rows to make it easier to follow

Data Entry Best Practices

Consistent Category System

Make a list of your categories before entering expenses:

Main Categories:

- Housing (Rent, Utilities)

- Food (Groceries, Restaurants)

- Transportation (Gas, Bus, Car Fixes)

- Entertainment (Movies, Games, Hobbies)

- Healthcare (Doctors, Medicine)

- Personal Care (Haircuts, Clothes)

Stick to these categories every time. If you change them often, your analysis won’t be accurate.

Efficient Data Entry Techniques

Excel Shortcuts:

- Ctrl+; – Add today’s date

- Ctrl+Shift+$ – Apply money format

- Tab – Move to the next cell

- Enter – Move to the next row

Dropdown Lists for Categories:

- Go to your Category column

- Click Data > Data Validation

- Choose List

- Type your categories with commas between them

AutoFill for Monthly Bills:

- Type in a pattern (like rent each month)

- Drag the cell down to repeat it for other months

Accuracy Maintenance Tips

- Double-check amounts – Small mistakes add up

- Review weekly – Fix errors early

- Use spell check – Keep names and notes neat

- Reconcile monthly – Compare Excel to your bank statement

Analyzing Your Expenses with Excel

Basic Analysis Functions

Total Spending:

- Use =SUM(D2:D100) to add up your expenses

By Category:

- Use =SUMIF(B2:B100,”Food”,D2:D100) to total just one category

Monthly Totals:

Use =SUMIFS with dates:

=SUMIFS(D2:D100,A2:A100,”>=”&DATE(2024,1,1),A2:A100,”<“&DATE(2024,2,1))

Averages:

- Use =AVERAGE for monthly totals

- Use =AVERAGEIF(B2:B100,”Food”,D2:D100) for category average

Excel Filtering for Quick Insights

Turn On Filters:

- Select your data

- Click Data > Filter

- Use drop-down arrows to filter

Helpful Filters:

- Pick a date range and category

- See all items over $100

- Choose certain payment types

- Look at a custom time frame

Pivot Tables for Advanced Analysis

Set Up a Pivot Table:

- Select your data

- Click Insert > PivotTable

- Drag Category to Rows

- Drag Amount to Values

More Features:

- Add Date for time-based tracking

- Use slicers to filter

- Make fields for percentages

- Create Pivot Charts to show results

Excel Charts for Visual Analysis

Types of Charts:

- Pie Chart – Shows category breakdown

- Bar Chart – Compares spending by month or category

- Line Chart – Shows how spending changes over time

How to Make a Chart:

- Pick your summary data

- Go to Insert > Charts

- Choose a chart type

- Customize colors and labels

Advanced Excel Expense Tracking Features

Budget Integration

Add Budget Columns:

- Monthly Budget

- What you spent

- Budget left

- Percent used

Formulas:

- Leftover budget: =Budget_Amount-SUMIF(Category,”Food”,Amount)

- Percent used: =Amount_Spent/Budget_Amount

Color Alerts with Conditional Formatting:

- Red: Over budget

- Yellow: 80% used

- Green: Under 50% used

Recurring Expense Management

Make a New Sheet:

Columns:

- Expense Name

- Amount

- Due Date

- How Often (Monthly, Quarterly)

- Category

Formulas:

- Monthly Total: =SUM(recurring_amounts)

- Yearly Total: =Monthly_Total*12

Goal Tracking Integration

Set Up a Savings Goal Tracker:

- Goal Name

- Goal Amount

- Current Savings

- Monthly Savings Needed

- Goal Date

Formulas:

- Progress: =Current_Savings/Target_Amount

- Months Left: =DATEDIF(TODAY(),Target_Date,”M”)

- Monthly Need: =(Target_Amount-Current_Savings)/Months_Remaining

Maintaining Your Excel Expense Tracker

Regular Update Schedule

- Daily: Most accurate, takes 5 minutes

- Weekly: Good balance, takes 20 minutes

- Every 2 Weeks: OK, but you might forget stuff

Pick a schedule based on how often you spend and your time.

Monthly Reconciliation Process

Bank Reconciliation:

- Export your bank data to Excel

- Sort by date

- Compare with your tracker

- Check off matched items

- Investigate any differences

Credit Card Reconciliation:

- Look over your monthly statement

- Match each charge to your Excel tracker

- Note pending charges

- Make sure payment dates and amounts are right

Data Organization and Backup

File Organization:

- Save a new file each year

- Use clear file names

- Track different versions

- Separate old from new data

Backups:

- Save in the cloud (like Google Drive)

- Use an external hard drive

- Use a password for private data

- Back up regularly

Excel Expense Tracking Tips for Success

Common Mistakes to Avoid

- Using different names for the same category

- Waiting too long to enter expenses

- Ignoring small purchases

- Skipping monthly checks

Motivation and Habit Building

Show Progress:

- Make charts for each month

- Show how close you are to budget goals

- Track savings growth

- Celebrate when you hit milestones

Set Review Times:

- Weekly: Look at what you spent

- Monthly: Review your budget

- Quarterly: Check on your savings goals

- Yearly: Plan for the next year

Excel Expense Tracking Automation

Keyboard Shortcuts:

- Ctrl+C/V – Copy and paste

- F2 – Edit a cell

- Ctrl+Z – Undo

- Alt+= – Add up numbers fast

Make a Template:

- Save your tracker layout

- Include all formulas and formats

- Share with family if needed

- Update the template each year

Troubleshooting Excel Expense Issues

Common Formula Problems

- #VALUE! – Fix number or date formats

- #REF! – Fix cell links

- Circular Errors – Avoid formulas that reference themselves

- Date Problems – Use the same format throughout

Performance Optimization

If Excel Is Slow:

- Archive old data

- Use simple formulas

- Avoid very complex functions

- Spread data over many sheets

Data Recovery

Version Control Tips:

- Save often

- Use AutoSave

- Keep backups

- Test your restore method

Must Read: 200 Creative Leadership Project Ideas For Students

Conclusion: Excel Expense Tracking Success

Using Excel to track your expenses helps you turn confusion into clear, helpful information. This system gives you the power to spend smarter, stick to a budget, and reach your goals faster.

You don’t need to be perfect—just stay consistent. Start small with basic columns and categories. Add more features as you get better at it.

The time you spend building and updating your tracker will pay off in stronger money habits and better control. Start today, even with something simple, and your confidence will grow each time you use it.

Remember: Excel is your tool, but discipline is what makes it work. Track regularly, review your numbers, and make changes based on what you learn.