Can Excel help in personal budgeting? Yes – absolutely! Excel is a super useful and powerful tool that can help you manage your money in a smart and organized way. People all over the world use Excel to take full control of their spending, saving, and financial planning.

Whether you’re just starting out and dealing with debt, or you already know a lot about money and want deeper insights, Excel can work for you. It’s much more flexible than other budgeting apps that have limited options. Excel lets you build your own budget exactly how you want it.

This guide will show you how to use Excel to manage your money better. I’ve helped people improve their financial spreadsheets for 25 years, and now I’m sharing the tips that will turn Excel into your best budgeting buddy.

Must Read: How Do Professionals Use Excel at Work: Complete Guide for 2025

Why Choose Excel for Personal Budgeting Over Other Tools?

Cost-Effectiveness and Accessibility

Excel gives you a lot of value compared to other budgeting tools:

- Saves money: Most people already have Excel through Microsoft Office, work accounts, or they can use free tools like Google Sheets or LibreOffice Calc.

- No monthly fees: Budgeting apps often charge $10–$50 a year, but Excel doesn’t.

- Helps your career: Learning Excel can help you at work, with business, or when tracking your investments.

- Learn new skills: You’re not just handling money—you’re learning useful tech skills.

- Works offline: You can use Excel even without the internet, unlike some budgeting apps.

- Keeps your info private: Your money data stays on your device, even if the internet is down or a service stops working.

Unmatched Customization and Flexibility

Excel can fit your life better than most apps:

- Change it how you want: You can make your own categories, track special income, or build custom savings goals.

- More options: Budgeting apps usually give you 15–20 set categories. Excel lets you create as many as you need.

- Easy updates: Add new income, remove old expenses, or rebuild your whole budget anytime—without losing past data.

- Fits your life: Excel changes with you. Whether you change jobs, grow your family, or face money challenges, Excel can adjust.

- Make it your style: Use colors you like and layouts that make sense to you.

- Helps you stick with it: When your budget feels personal, you’re more likely to keep using it.

Advanced Analytical Capabilities

Excel has strong tools for deep money tracking:

- Handle tricky plans: Use Excel to plan debt payments, track investments, or look at spending over the years.

- Powerful functions: Excel has tools like XIRR, PMT, and FV to help you do big financial calculations.

- See your spending: Charts and graphs help you understand where your money goes better than just a list of transactions.

- Spot trends: You can predict future spending and see problem areas before they get worse.

- Make smarter choices: With clear insights, you can make better money decisions than with simple apps.

- Use with other tools: You can import bank data, link investments, and export for taxes easily in Excel.

Essential Components of an Effective Excel Budget Worksheet

Income Tracking Structure

To track your income well, you need a clear setup:

- List all income sources: Write down your main salary, freelance money, rent income, side jobs, and bonus checks.

- Use net income: Track the money you actually take home, not your full (gross) income. This gives you a more accurate budget.

- Think about timing: Weekly pay is different from monthly or random payments. Plan for each type.

- Separate types: Make one section for regular income and another for income that changes month to month.

- Plan for timing changes: Some months have extra paychecks if you’re paid every two weeks or weekly. Be ready for this.

- Stay safe with a buffer: Plan for months when you earn less. This keeps your budget strong.

Comprehensive Expense Categories

- Fixed expenses: These are regular costs like rent, loans, insurance, and subscriptions. They stay about the same each month and should be planned for first.

- Variable expenses: These change from month to month. Things like groceries, eating out, or fun activities can go up or down. Use past data to estimate them.

- Irregular expenses: These happen once in a while, like car repairs, holiday gifts, or yearly insurance. Set aside small amounts each month to cover them when they come up.

Strategic Savings Goal Integration

- Short-term savings goals: Save for things like emergencies, vacations, or big purchases in the next 1–2 years. Pick a goal, then save a set amount each month.

- Long-term savings goals: These take years to reach, like saving for retirement, a house, or college. Track both how much you add and how much it grows.

- Use visuals to stay motivated: Create charts that show how close you are to each goal. Seeing your progress keeps you excited and focused.

Debt Management Integration

- List all debts: Include credit cards, car loans, student loans, and your mortgage. Write the balance, interest rate, minimum payment, and when you plan to finish paying.

- Compare payment strategies: Use Excel to try different debt payoff plans—like the avalanche (highest interest first) or snowball (smallest balance first).

- Track extra payments: Even small extra payments can save you a lot over time. Use Excel to see how much faster you can pay off debt.

Step-by-Step Excel Budget Creation Guide

Layout Planning and Structure Design

- Pick your layout: You can use one sheet or many. One sheet works if your budget is simple. Use more sheets if your finances are complex, like one for income, one for spending, and one for debt.

- Use clear columns: Add columns like Date, Description, Category, Budgeted Amount, Actual Amount, and Remaining Balance. You can also add Payment Method, Notes, or Tax Info if needed.

- Make headers easy to read: Use bold text, borders, and background colors so your headers stand out. This helps avoid mistakes and makes entering data easier.

Data Input and Organization Systems

- Keep your data entry consistent: Use the same words, formats, and categories every time. This makes it easier to search, sort, and analyze your budget later.

- Use dropdown menus: Make a list of your spending categories on a different sheet. Then, create dropdowns to pick from. This saves time and avoids spelling errors.

- Enter data regularly: Don’t wait too long. Update your budget every day or week. It takes less time and keeps your budget accurate. Small steps are better than doing everything at once.

Essential Formula Implementation

- Use SUM to add things up: The SUM formula adds totals for income, expenses, or your full budget. Use SUM(range) or SUMIF if you want to add up only certain things, like all grocery spending.

- Check your budget vs. spending: Use a formula to subtract your actual spending from your budgeted amount. If you spent less, it’s a good sign. Use color formatting to show results: green for under budget, red for over.

- See where your money goes: Turn spending into percentages of your income. This helps you see how much you spend on things like rent, food, or entertainment. Use this to compare with suggested limits like rent being under 30% of income.

Advanced Excel Budgeting Techniques for Power Users

Conditional Formatting for Visual Budget Management

- Use colors to show spending: Conditional formatting helps you see your budget better. Make Excel highlight cells red when you spend too much, green when you save money, and yellow when you’re getting close to your limit.

- Show savings progress with bars: Add progress bars that grow as you save more. It’s a fun and clear way to see how close you are to reaching your savings goals. You can do the same for paying off debt.

- Add icon sets for quick updates: Use traffic light icons (green, yellow, red) or arrows (up, down, sideways) to show how well you’re doing. These icons help you understand your budget quickly without looking at all the numbers.

Pivot Table Analysis for Deep Financial Insights

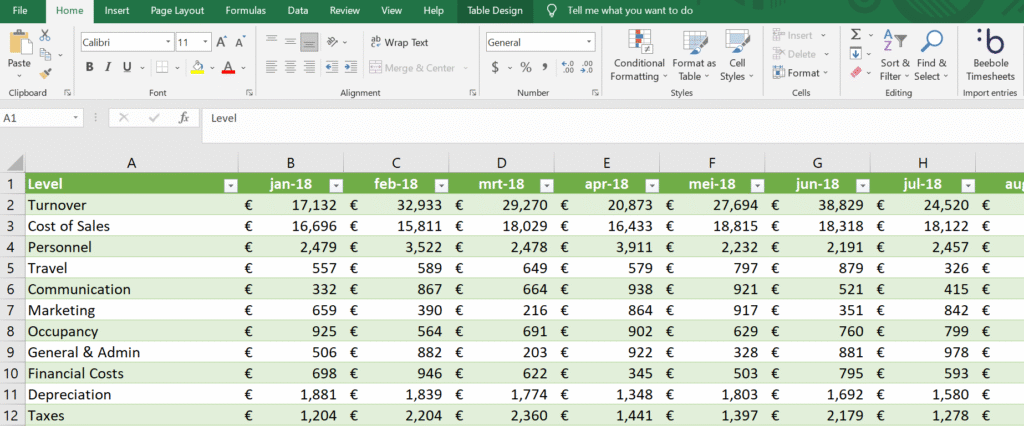

- Use pivot tables to summarize data: Pivot tables help you sort and group lots of data fast. You can look at how much you spent by month, by type of expense, or by where you spent it.

- Make reports update by themselves: Pivot tables change automatically when you add new data. You don’t have to redo everything each time. This saves a lot of work.

- Look at spending from different angles: You can see things like how much you spent on groceries each month. This helps you find patterns or problems. It gives you a better look at your habits.

Scenario Analysis and Financial Modeling

- Use Goal Seek to plan ahead: Excel’s Goal Seek tells you what needs to change to hit your goals. For example, it can show how much more you need to earn or how much less you need to spend.

- Try different situations with data tables: You can test what happens if your income goes up or if your bills go down. See how these changes affect your budget.

- Find what matters most: Sensitivity analysis shows what changes have the biggest effect on your goals. You can see if cutting spending or increasing income helps more. Then you’ll know where to focus first.

Pros and Cons: Excel vs. Budgeting Apps Comparison

Excel Advantages for Personal Budgeting

- Fits your needs perfectly: Excel lets you create a budget that matches your exact money situation. Unlike apps that force you to use set categories, Excel gives you full freedom to create your own.

- No monthly fees: You don’t have to pay every month to use Excel. If you already have it or use a free version like Google Sheets, it’s a one-time setup with no extra cost.

- Keeps your data safe: Your budget file stays on your computer. You don’t need to put your personal money information online, which means more privacy and fewer security worries.

- Teaches valuable skills: Using Excel helps you learn helpful skills for school, jobs, or even starting a business. While managing your money, you’re also getting better at using a tool many jobs require.

Excel Limitations and Challenges

- Takes more time: With Excel, you have to enter your spending by hand. Budgeting apps often link to your bank account and add transactions automatically, which saves time.

- Easy to make mistakes: If you type the wrong number or delete a formula, it can mess up your whole budget. Apps usually check for errors automatically.

- Harder to use on phones: While you can use Excel on a phone, it’s not as fast or simple as budgeting apps. Apps are made for quick updates, like while you’re shopping or eating out.

- Steep learning curve: If you’re new to Excel, it may feel confusing at first. Apps are usually easier to start using, but Excel needs some practice to get used to the tools and formulas.

Expert Tips for Excel Budgeting Success

Consistency and Habit Formation

- Stick to a schedule: Update your budget every week, not just once in a while. Regular check-ins help you stay on track and avoid falling behind. Treat budget time like an important meeting.

- Start simple: Don’t try to build a complicated budget right away. Begin by just tracking what you earn and spend. As you learn more, you can add extra features step by step.

- Use templates: Start with a ready-made Excel budget template. Microsoft has many to choose from. Then change it to match your own money goals and spending style.

Data Protection and Backup Strategies

- Back up your files: Save your budget in more than one place, like a flash drive or cloud storage. That way, if one file gets lost or broken, you still have a copy.

- Add a password: If your budget has private info, protect the file with a password. This keeps your money details safe if someone else uses your device.

- Keep old versions: Save a new copy of your budget each month or use Excel’s version history. These older versions help you track changes and are useful at tax time.

Continuous Improvement and Optimization

- Make updates often: Review how your budget is working and fix what’s not. If you never use a certain category, remove it. If something’s missing, add it in.

- Check spending trends: Every few months, look at where your money goes. You might notice some categories are growing or see patterns that help you make better choices.

- Celebrate your wins: Give yourself credit when you reach a money goal or stick to your plan. Celebrating small steps keeps you motivated and proud of your progress.

Must Read: What Is Data Validation in Excel?

Conclusion: Excel as Your Personal Finance Foundation

Excel is more than just a tool for tracking spending. It helps you take full control of your money. Because it’s flexible and powerful, you can build a budget that fits your life—and change it as your needs grow.

While budgeting apps are quick and easy, Excel gives you deeper insights and more control. It also helps you learn useful skills like charts, formulas, and tracking. These skills can help with school, work, or even running your own business one day.

To get the most from Excel, you need to use it regularly and keep learning new tricks. Start simple—just track what you earn and spend. As you get more comfortable, add savings goals, charts, and debt trackers. Keep your data up to date.

Your money matters, and Excel gives you the tools to understand and manage it. It’s worth the time to learn because it helps you make smart decisions now and in the future.

Ready to begin? Download a budget template or open a blank Excel sheet. Start with the basics, and build your way toward full financial control. With Excel, your journey toward better money management starts today.